e-Invoice

E-Invoicing for Prestige Atlantic Asia

The Malaysian government’s e-invoicing initiative is a monumental shift towards a digitized tax system, aiming to bring greater transparency and efficiency to business transactions. We are also fully compliant with tax regulations in both Singapore and Indonesia.

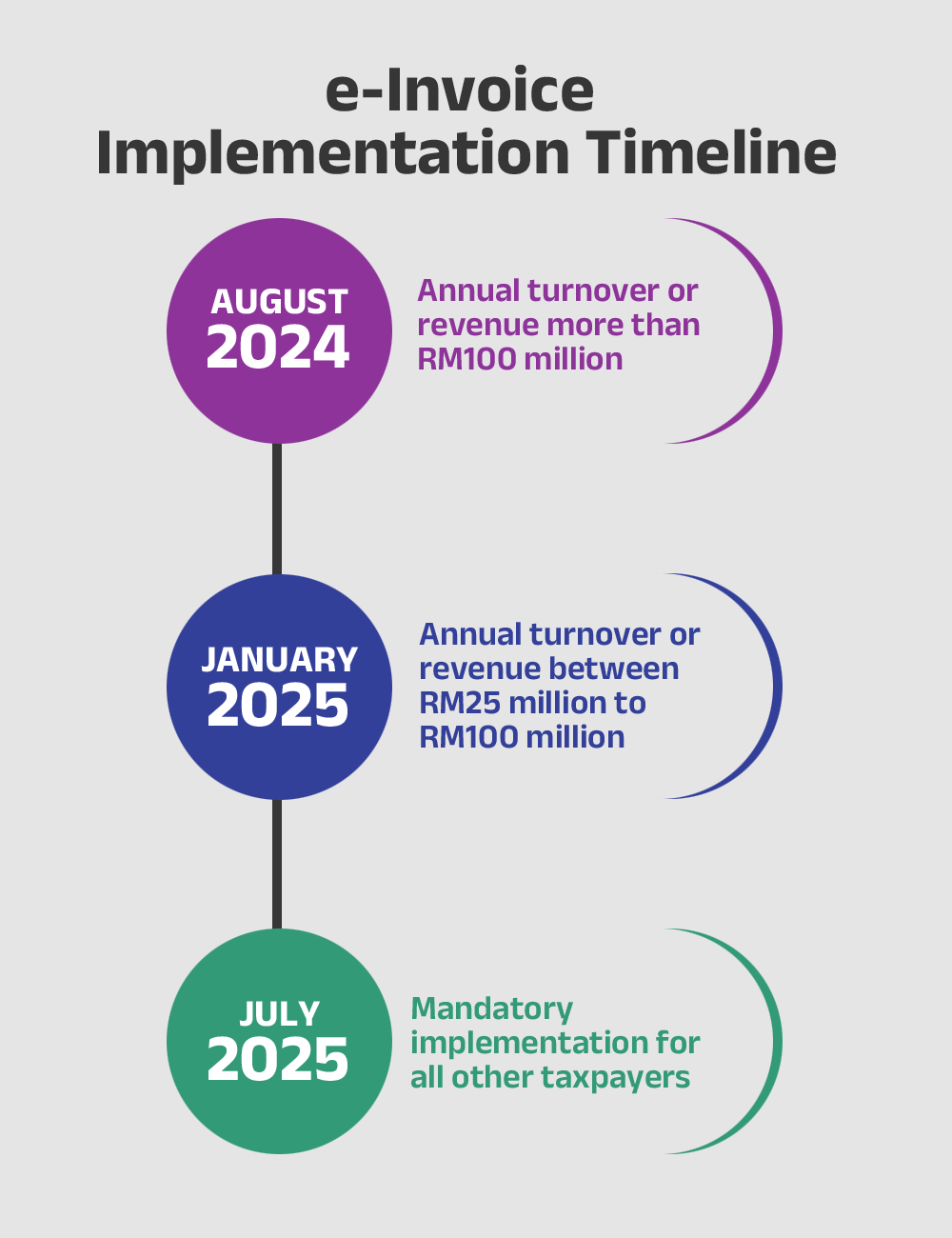

This phased rollout, starting with large taxpayers in August 2024 and progressively encompassing smaller businesses by January 2026, requires all businesses operating in Malaysia to adapt to a standardized, machine-readable e-invoice format validated by the Inland Revenue Board of Malaysia (IRBM)’s MyInvois System.

This move impacts all transaction types – Business-to-Business (B2B), Business-to-Consumer (B2C), and Business-to-Government (B2G), including cross-border dealings. Businesses can choose to submit e-invoices manually through the MyInvois Portal or via API integration with their existing Enterprise Resource Planning (ERP) or accounting systems. The benefits are far-reaching, from enhanced tax compliance and improved operational efficiency to faster payment cycles and a more robust digital economy.

In this transformative landscape, companies like Prestige Atlantic Asia Sdn Bhd are proactively embracing the e-invoicing mandate to ensure seamless operations and full compliance. As a leader in ERP IT solutions for the paper and packaging industry across Southeast Asia, Prestige Atlantic Asia has publicly stated its commitment to integrating the MyInvois solution.

This strategic move by Prestige Atlantic Asia highlights their dedication to:

- Proactive Compliance:

By integrating the MyInvois solution, Prestige Atlantic Asia is ensuring that its systems are ready to generate, submit, and validate e-invoices according to IRBM’s guidelines, well in advance of the mandatory deadlines for its relevant operational phases. - Operational Streamlining:

Leveraging their expertise in ERP systems, Prestige Atlantic Asia’s integration will automate their invoicing processes, reducing manual errors, speeding up transaction flows, and improving overall efficiency for both their own operations and their clients. - Enhanced Transparency:

By adhering to the e-invoicing standards, Prestige Atlantic Asia contributes to the greater transparency in financial reporting and tax administration that the Malaysian government seeks to achieve. - Uninterrupted Business:

Their compliance efforts ensure that business operations remain smooth and uninterrupted, allowing them to continue serving their clients effectively within the new regulatory framework.

Prestige Atlantic Asia is fully compliant with e-invoicing regulations in Malaysia, Singapore and Indonesia underscores the broader trend of businesses adapting to digital transformation to foster transparency, efficiency, and sustained growth in the evolving economic landscape. This also positions them as a reliable partner for other businesses within the paper and packaging industry seeking to navigate these new requirements.

Ready to transform your corrugated paper business into a smart, scalable enterprise?

Contact Us Today to schedule a demo and see how Prestige Atlantic Asia can power your growth.